Best Payday Loans 2024: All Credits Welcome

If you need cash fast until your payday, and you’ve already been rejected by banks due to your credit or employment situation, payday loans are the best way to get the money you need today.

This is why we have built a list of the 7 best payday loans you can borrow online nowadays, offered by the highest-rated brokers and companies in the industry, featuring the lowest APRs, instant approval, fastest disbursement, largest lending amounts and highest approval rate.

We invite you to check out our ranking below, to pick your ideal payday loan solution and get the money you need as soon as possible.

List of the Best Payday Loans 2024

Here you have our selection of the top brokers and companies for borrowing a payday loan in 2024, featuring the lowest APR, largest range of lending amounts, instant approval and same day disbursement:

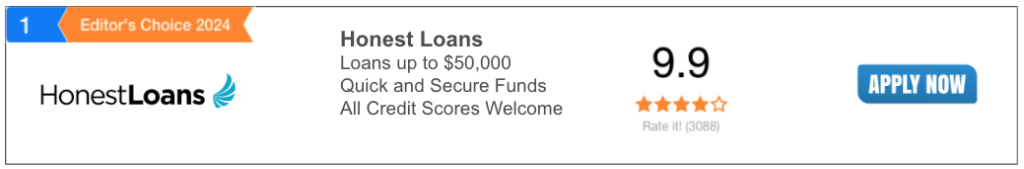

- Honest Loans: Best overall choice for payday loans

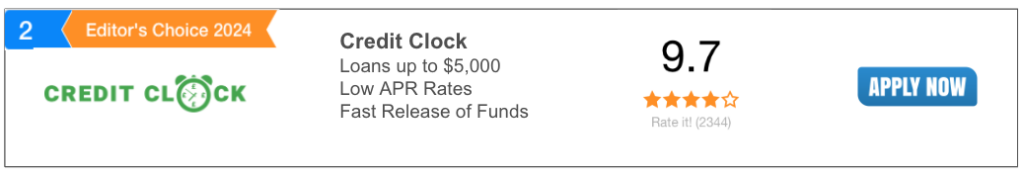

- Credit Clock: Best for emergency payday loans

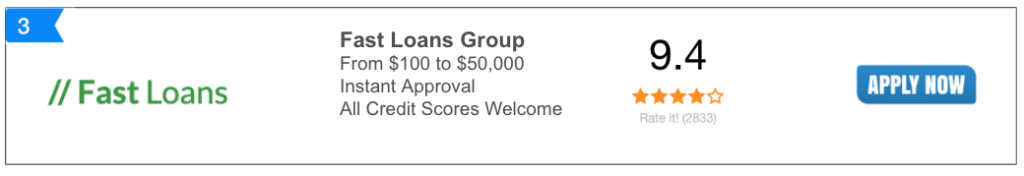

- Fast Loans Group: Fastest payday loans

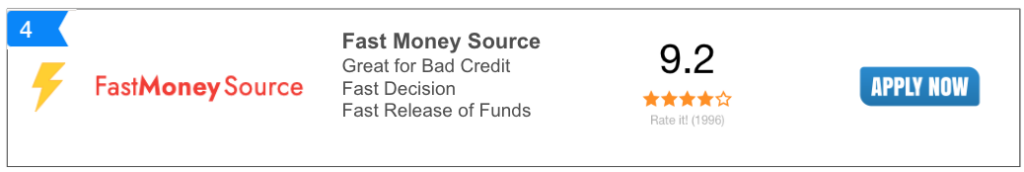

- Fast Money Source: Cheapest payday loans

- Big Bucks Loans: Highest approval rate for bad credit

- Heart Paydays: Easiest online application

- Low Credit Finance: Plenty of offers from direct lenders

To apply for an online payday loan, just click on the name of your preferred broker from our list, fill out the application form and you’ll get an instant decision, and if you’re approved, you will receive the money the same day.

However, if you’d like to get more details about each one of our recommended payday loan companies before choosing one, we invite you to check out our reviews below.

1. Honest Loans: Best Overall for Payday Loans

If you are looking for a broker or company that meets the highest standards of payday loans, Honest Loans is the option you need to check out. It stands out thanks to its low APR, high approval rate, flexible repayment periods and the possibility to borrow up to $50,000 with instant approval and same day disbursement.

2. Credit Clock: Best for Emergency Payday Loans

Payday loans are the solution for people who need money fast, but the vast majority of brokers and companies won’t be able to disburse the money if you request it late at night or during holidays. In these situations, Credit Clock is the best choice for you, renowned as the top solution for emergency payday loans nowadays.

Thanks to Credit Clock, you can borrow up to $5,000 at any time or day of the week at a competitive APR, with instant approval and express disbursement within 3-4 hours.

3. Fast Loans Group: Fastest Payday Loans

If you need money as soon as possible, even faster than what the regular payday loan broker can offer you, you need to check out Fast Loans Group. Widely recognized as the fastest payday loan solution nowadays, it features easy online application, instant approval and disbursement in 1 hour or less.

Fast Loans Group allows you to borrow up to $50,000 with instant approval and the fastest disbursement in the industry, along with one of the lowest APR nowadays.

4. Fast Money Source: Cheapest Payday Loans

It’s not a secret payday loans are pricier than your regular personal loan, however Fast Money Source does a fantastic job at offering the lowest APR, often rivaling traditional lenders and banks… even if you have bad credit.

Offering payday loans for up to $50,000 with instant approval, a high approval rate and same day disbursement, it’s the best choice for borrowing a cheap payday loan online.

5. Big Bucks Loans: Highest Approval Rate for Bad Credit

While payday loans offer a much higher approval rate than conventional personal loans, it’s true you can still get rejected if you’re excessively indebted or if you have low income. For these situations, Big Buck Loans is a godsend, since it offers you an approval rate of 90%.

Big Buck Loans allows you to borrow up to $5,000 with a few clicks, and since it accepts practically all customers, you can rely on it to get money fast.

6. Heart Paydays: Easiest Online Application

Especially if you’re on mobile, it’s stressful having to deal with a multi-step loan application process. Aware of this problem, Heart Paydays has revolutionized the way people can borrow payday loans online, by offering the easiest, simplest and fast application process in the industry, which you can complete in 5 minutes or less.

You can borrow up to $5,000 thanks to Heart Paydays, featuring instant approval and express disbursement, along with a competitive APR and flexible repayment periods.

7. Low Credit Finance: Plenty of offers from direct lenders

If you’d like to compare several payday loan offers from different direct lenders, Low Credit Finance is the right broker for you. Featuring the largest network of direct lenders for payday loans, you can compare dozens of different offers easily to find the ideal solution for you.

Low Credit Finance will connect you with direct lenders willing to lend you up to $5,000 with flexible repayment periods and a competitive APR, making it one of the best choices for borrowing money fast online.

How to Apply for a Payday Loan Online

If you have already selected your preferred broker or company from our list, but you don’t know how to apply, here’s how you can do it to get the money you need today:

- Click on your preferred broker from our list

- Visit the official website and find out the application form

- Fill out the application form with precise and real data

- Click on “Submit” and wait for instant approval

- Review the available offers and pick your preferred one

- Agree to the terms and conditions of the contract

- Receive the money the same day

The application process will take you less than 10 minutes, and since our recommended brokers offer instant approval and same day disbursement, you’ll get the cash you need in record time.

In case you still have questions about payday loans and our recommended brokers, the next section will bring you more information such as the pros and cons of this type of loan, details about credit score and approval rate, amongst other key topics.

Eligibility for a Short Term Loan Online

To qualify for a short term loan online, you must meet a specific eligibility criteria, and here you have the requirements you must fulfill to be eligible for this loan product:}

- US citizen or permanent resident

- You must be at least 18 years old

- Email address

- Phone number

- Active bank account number

- Verifiable, steady, and recurring source of income

- Low to moderate debt-to-income ratio (DTI)

As you can see, it’s easy to qualify for a short term loan online, and this is why our recommended companies offer an approval rate as high as 90%. Therefore, even if you have bad credit, you stand a high chance at getting approved, so we encourage you to apply now to get the money you need in record time.

Pros and Cons of Payday Loans

The quickest and most effective way to see if payday loans are the right choice for you is by comparing their pros and cons, hence the following table will bring you all the details you need.

| Pros | Cons |

| Fastest way to borrow money online | Higher interest rate than conventional personal loans |

| Accepts all types of credit | They are not available in all states |

| Borrow from $100 to $50,000 easily | |

| Flexible repayment periods up to 60 months | |

| No paperwork necessary | |

| Lowest APR for payday loans | |

| Easy online application with instant approval | |

| Same day disbursement |

The pros of payday loans make it an excellent choice when you need cash fast and traditional lenders and banks won’t approve your loan application due to bad credit, low income, being unemployed or highly indebted.

If it sounds like your case, there’s no better option in the market for borrowing fast money than

payday loans, and since we have picked the best brokers and companies for this type of lending, you’ll get the money you need with the lowest APR and most flexible repayment periods.

Are Payday Loans the Same As Cash Advances?

Yes, payday loans and cash advances refer to the same type of loan. Some companies and brokers decide to advertise them as cash advances until your payday, but as you can easily guess, they refer to the same product.

Therefore, all mentions of cash advances, such as cash advance loans and cash advance apps, are essentially payday loans. Therefore, if you arrived here looking for a cash advance, you can apply through our recommended brokers and they will connect you with the right direct lender.

If you are on mobile and you were looking for a cash advance app, you’ll be happy to know our recommended brokers and companies are 100% mobile friendly. You can apply on Android and iOS easily in just a few clicks, allowing you to borrow the money you need in record time.

About Credit Score and Payday Loans

If you’re concerned about your credit score affecting your eligibility when applying for an online payday loan, just don’t, because it’s not an important factor. While brokers and companies will use it to calculate the APR of your loan, you can get approved with bad or extremely bad credit.

When it comes to payday loans, the most important requirement you must meet is having a consistent, steady and verifiable source of income. If you meet this criteria, and it’s enough to cover the costs of the payday you want to borrow, you’re highly likely to be approved.

Nonetheless, it’s our responsibility to inform you that a bad or extremely bad credit score will lead to a higher payday loan, but since we have selected the top brokers in the industry, you’ll get a competitive APR regardless, allowing you to borrow money at an affordable rate.

When Is It a Good Idea to Borrow a Payday Loan?

Although payday loans are the fastest way to get a cash advance until payday, it’s understandable you might be worried it won’t be the best choice for you. Therefore, here you have a checklist that will help you decide if it’s a good idea to borrow a payday loan:

- Do you need the money today?

- Do you have zero credit history?

- Is your credit rated as Fair, Poor or Extremely Poor?

- Are you unemployed, self-employed or have an alternative source of income?

- Are you highly indebted?

- Do you prefer applying online with zero paperwork?

- Are you looking forward to repaying the loan on your next payday?

If you have answered “yes” to the majority of the questions, it’s safe to say it’s a good idea to borrow a payday loan in your case, as it’s the product that will offer you money the fastest and is the most likely to approve you regardless of your credit situation.

Our Methodology

Our team of finance and FinTech specialists have invested 300+ hours analyzing the industry, reviewing and comparing all the payday loan brokers and companies in existence, to identify the solutions that meet the following standards:

- High Approval Rate: Our recommended brokers and companies feature an approval rate as high as 90%, even for customers with bad credit, extremely bad credit, highly indebted or currently unemployed

- Low Interest Rate: Determined to help you borrow money fast at the lowest rate, we have only selected brokers and companies that offer the lowest APR in the industry for this type of lending solution

- Flexible Repayment Periods: You have specific needs and goals, hence we have only selected brokers and companies that offer flexible repayment periods, allowing you to repay it as soon as on your next payday or over the next 12 months

- Flexible Lending Amounts: Because you have unique needs, our selected brokers and companies can lend you as little as $100 or as much as $50,000

- Instant Approval and Fast Disbursement: All of our recommended solutions approve online payday loan applications instantly and offer same day disbursement

- Honest and Clear Contracts: No small letters or hidden clauses, all of our recommended companies offer honest and clear contracts, allowing you to see exactly what you’re getting and what will be your responsibilities.

As you can see, you can rely on our recommended brokers and companies to get the payday loan you need now – we invite you to apply to obtain the money today.

Bottom Line

Payday loans are the ideal solution when you need money fast and your credit situation won’t help you qualify for a conventional personal loan. Since we have selected the brokers with the lowest APR, fastest disbursement, most flexible repayment periods and highest approval rate, now you can borrow the money you need under the most favorable conditions.

Tailored Payday Loan Options

Client Testimonials

Why Choose Us?

Discover the advantages of opting for Short Term Loans Online for your payday loan needs.