Short Term Loans Online 2024: Get Fast Cash Now

Do you need cash as soon as possible to make ends meet? Be it due to unexpected bills, or the ever rising cost of living in the US, our recommended short term loans online are here to bring you the quick and easy funding you need right now.

We have carefully selected the top brokers and companies in the US offering short term loans online with flexible repayment periods, a low APR and a wide range of lending amounts from $100 up to $50,000, even if you have bad credit or no credit history.

Check out our ranking below to get the money you need right now.

Top Companies for Short Term Loans Online in the US

Here you have the best companies in the US for getting short term loans online:

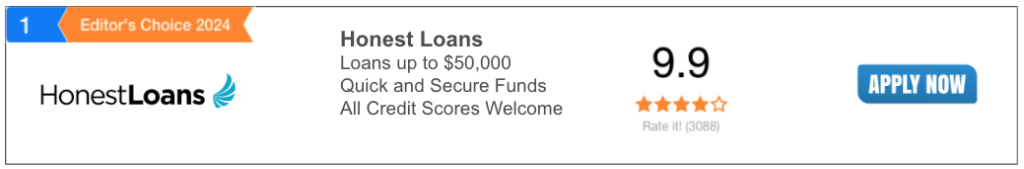

- Honest Loans: Best overall company for short term loans online

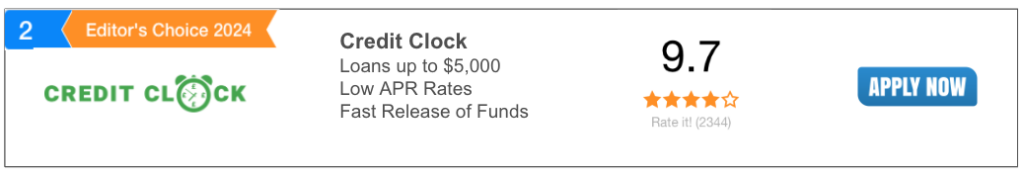

- Credit Clock: Best for emergency short term loans online

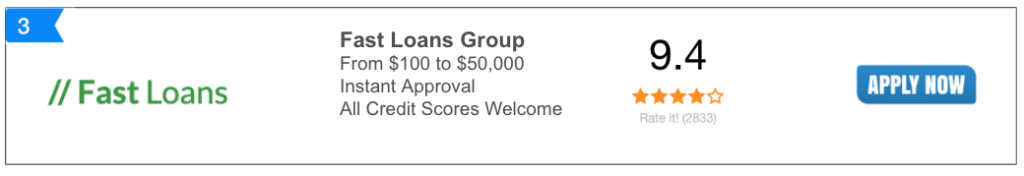

- Fast Loans Group: Fastest disbursement for short term loans online

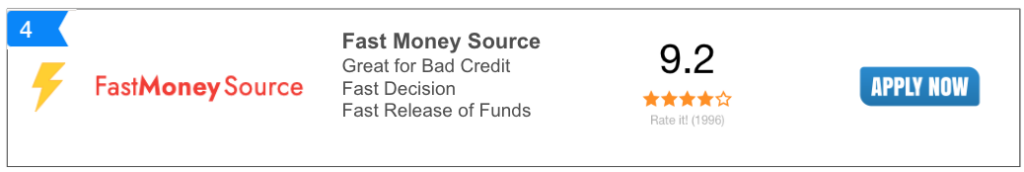

- Fast Money Source: Lowest APR for short term loans

- Big Bucks Loans: Best for bad credit

- Heart Paydays: Easiest online application with instant approval

- Low Credit Finance: Largest number of short term loan offers

Just click on your favorite company from our list, fill out the quick and easy online application form and you’ll receive an instant approval decision, and if you’re approved, you’ll receive the money you need the same day.

If you’d like to learn more about our selected brokers, below you fill find a concise review about each one.

1. Honest Loans: Best overall company for short term loans online

If you’re looking for a broker that ranks high in all the departments that matter, Honest Loans is the best choice for you. Offering short term loans from $100 up to $50,000 with a low APR and fees, flexible repayment periods, accepts highly indebted customers, instant approval, same day disbursement and an approval rate of 90%, it’s easy to see why it’s the #1 choice in the US for short term loans online in 2024.

Therefore, it’s the ideal choice for all types of customers, including those with bad credit, no credit history or low income.

2. Credit Clock: Best for emergency short term loans online

If you need money as soon as possible, even on the weekend or holiday, you can rely on Credit Clock to borrow the cash you need right now regardless of the day or the hour. Thanks to its 24/7 service, you can borrow from $100 to $5,000 even on a Sunday at 3 A.M., with instant approval, express same day disbursement and a low APR with flexible repayment periods.

Even though their approval rate is lower than Honest Loans, it’s still an excellent choice, especially if you need money fast for an emergency.

3. Fast Loans Group: Fastest disbursement for short term loans online

Even though all of our recommended brokers can approve your application instantly and disburse the money the same day, Fast Loans Group is the quickest amongst them, because they can lend you the money you need in as little as 1 hour.

In addition to the instant approval and fastest disbursement, Fast Loans Group also features a low APR, high approval rate and lending amounts from $100 to $50,000, bringing you the ideal solution for borrowing money for the short term online.

4. Fast Money Source: Lowest APR for short term loans

If you are shopping for the lowest APR for a short term loan online, Fast Money Source is the perfect choice for you, because it offers the cheapest APR and fees in the industry for this type of loan. With lending amounts from $100 up to $50,000 with instant approval and same day disbursement, it’s a great choice for borrowing money fast at a low cost.

5. Big Bucks Loans: Best for bad credit

If banks, traditional lenders and brokers have already declined your online loan application due to your bad credit score, Big Buck Loans can help you. Offering an approval rate higher than 90%, especially for customers with extremely bad credit and no credit history, Big Buck Loans can lend you from $100 up to $5,000 for the short term, with a low APR and instant approval.

6. Heart Paydays: Easiest online application with instant approval

Heart Paydays is the best option in the market if you’re looking for a broker with the easiest online application process with instant approval. Especially designed and engineered to help you send your application in less than 5 minutes, Heart Paydays makes it practical for you borrow up to $5,000 for the short term with a low APR and same day disbursement in just a few clicks.

7. Low Credit Finance: Largest number of short term loan offers

If you’re looking for a broker that can serve you with the highest number of short term loan offers, Low Credit Finance is the perfect choice for you. Featuring the largest network of direct lenders in the US, lending amounts from $100 up to $5,000, high approval rate for bad credit and instant approval, Low Credit Finance is a broker worth exploring.

If you’ve already selected a company from our ranking but you don’t know how to apply, below you’ll find a tutorial that will guide you step by step.

How to Apply for a Short Term Loan Online

Here is how you can apply for a short term loan online via any of our recommended companies to get the money you need now:

- Click on the name of your preferred broker

- Visit the official website

- Fill out the application form with all the necessary information: names, phone, income details, employment details, etc.

- Click on “Submit”

- Wait for the broker to let you know if you have been approved (instantly)

- Agree to the terms and conditions of the short term loan contract

- Receive the money you need within 2 to 4 hours (same day)

As you can see, it’s very easy to apply for a short term loan online through our recommended companies, and you can expect to receive the money you need the same day.

If you’d like to learn more about this special type of personal loan and our recommended companies, below you will find all the information you need.

What Are Short Term Loans Online?

They are personal loans especially designed for the short term, bringing you the opportunity to borrow from $100 to $50,000 by completing a fast and easy online application process, available 24/7 on desktop and mobile (iOS and Android).

Furthermore, as their name clearly suggests, these loans have been designed to be repaid in the short term, usually ranging from a couple of weeks until 12 months. This is the main difference versus classic installment loans, which the majority of customers repay in more than 12 months, for example in 36 months.

Online lending started in the 1980s, completely revolutionizing the lending industry. Companies such as Quicken Loans in Detroit identified how overwhelming it was to request a loan in person, with several hours invested in paperwork and handling. This is why they decided to introduce online lending, and since then, this special type of loan has been evolving constantly, until bringing us high-tech solutions such as short term online loans.

Offering a 100% online application, review, approval and disbursement process, short term loan online companies offer the quickest and easiest way to borrow money nowadays in the US, regardless of credit score or current income situation.

Due to their characteristics, short term loans online also receive other names such as emergency loans, short term payday loans and short term loans for bad credit.

Now that you know what short term loans online are, below you will find more details about the eligibility criteria you must meet to obtain this product.

Eligibility for a Short Term Loan Online

To qualify for a short term loan online, you must meet a specific eligibility criteria, and here you have the requirements you must fulfill to be eligible for this loan product:}

- US citizen or permanent resident

- You must be at least 18 years old

- Email address

- Phone number

- Active bank account number

- Verifiable, steady, and recurring source of income

- Low to moderate debt-to-income ratio (DTI)

As you can see, it’s easy to qualify for a short term loan online, and this is why our recommended companies offer an approval rate as high as 90%. Therefore, even if you have bad credit, you stand a high chance at getting approved, so we encourage you to apply now to get the money you need in record time.

Benefits of Getting Cash via Short Term Loans

If you are still unsure about getting the cash you need by requesting a short term loan, here you have all the benefits you’ll enjoy.

Fast Application and Instant Approval

Our recommended brokers offer a fast and easy online application process, along with instant approval. You’ll get to know instantly if you qualify for the loan, allowing you to get the money you need right now in record time.

Therefore, if you’re tired of the paperwork and handling you must undergo when requesting a loan from a bank or traditional lenders, now you have a solid alternative to get the money you need as soon as possible.

Same Day Disbursement for Fast Money

If you’re looking for this type of personal loan, chances are you need money fast, and this is exactly what our recommended brokers and companies can offer you. Featuring same day disbursement in 2-4 hours after being approved, you can rely on our selected brokers to get the money you need as soon as possible.

High Approval Rate

If you’re here because banks and traditional lenders have already rejected your loan applications, you’ll be happy to know our recommended brokers and companies offer an approval rate of 90%, the highest in the industry in the US.

You can qualify for a short term loan through our selected companies and brokers even if you have bad credit, extremely bad credit, no credit history, low income or if you’re unemployed, making it easy and practical to get the cash you need right now.

Flexible Repayment Periods for the Short Term

You need money and you want to repay it as soon as possible, and thanks to our recommended brokers, you’ll have the opportunity to choose amongst different repayment periods. Be it as short as 1 week, or as long as 12 months, our recommended companies will bring you the flexibility you need to repay your loan with peace of mind.

Low APR and Fees

Just because you need a short term loan, it doesn’t mean you have to pay outrageous fees and APR. This is why our recommended brokers are your best choice, because they charge the lowest APR for short term loans in the industry, to make it practical and affordable for you to borrow money through our selected companies.

F.A.Q

For more information about short term loans and our recommended brokers and companies, below you will find the answers to the most frequently asked questions about them.

Can you qualify for a short term loan if you have bad credit?

Yes, it is possible to qualify for an online loan for the short term even if you have bad credit, because brokers and companies don’t rely on your credit score when determining your eligibility for the loan you want to borrow.

Can you qualify for a short term loan if you have low income?

Yes, you can qualify for this type of personal loan even if you have low income, as long as it’s enough to repay the loan, you can borrow the money you need through our recommended brokers and companies.

Is it possible to qualify for a short term loan if you’re unemployed?

Yes, you can qualify for a short term loan online even if you’re unemployed. If you have an alternative verifiable source of income, our recommended brokers and companies can help you borrow the money you need right now.

Are short term loans online secured?

No, our recommended short term loans online are not secured, hence you don’t need collateral to get approved. If you meet the eligibility criteria, such as having a verifiable and steady source of income, you can qualify for borrowing money via a short term loan.

Can you get approved for a short term loan if you’re highly indebted?

Yes, as long as your debt to income ratio (DTI) is not higher than 50%, you stand a high chance at getting approved for a short term loan through our recommended brokers and companies.

Why Choose Short Term Loans Online

Transparent Process

We prioritize honest and clear terms, ensuring you understand all aspects of your loan without hidden fees.

Efficient Service

We streamline the loan selection process, matching you with trusted lenders quickly for your convenience.

Varied Options

With a wide range of lenders and loan amounts available, we accommodate diverse financial needs effectively.

Tailored Payday Loan Options

Client Testimonials

Why Choose Us?

Discover the advantages of opting for Short Term Loans Online for your payday loan needs.